One year after its nationwide launch, Bank of America’s conversational intelligent assistant Erica has achieved significant milestones. Recently, BofA touted the success of its digital banking assistant that uses natural language processing and predictive analytics to engage digital banking customers. Among the notable achievements:

One year after its nationwide launch, Bank of America’s conversational intelligent assistant Erica has achieved significant milestones. Recently, BofA touted the success of its digital banking assistant that uses natural language processing and predictive analytics to engage digital banking customers. Among the notable achievements:

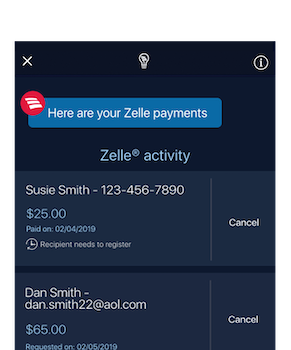

- Completed over 50 million client requests, including banking activities and more complex tasks

- 500,000 new users per month engage with Erica

- Expanded its knowledge base of financial questions from 200,000 at launch to more than 400,000 today

- Cross-generational engagement, with 15% from Gen Z, 49% millennials, 20% Gen X and 16% baby boomers/seniors

The growth of Erica fits Opus Research’s view of how purpose-driven conversational services have evolved to address the immediate needs of digital customers. Enterprise intelligent assistants, like Erica, capture and categorize common questions to provide correct answers. This enterprise utility helps ingest, aggregate and assemble increasing amounts of customer conversations to help support omnichannel strategies and enable digital self-service anytime, any place, and on any device.

While a deeper dive into the technology architecture and cognitive resources for Erica is in order, BofA’s success with its intelligent assistant points to an evolutionary step in the growth of Conversational Commerce. Opus Research has chronicled the rise of chatbots and virtual assistants and what it takes for successful deployments based on real-world experiences. Erica’s milestones demonstrate the ubiquity of Conversational AI and how easily it is for customers to engage with self-service resources for a wide range of digital banking activities.

To that end, Bank of America says it committed to Erica and “will continue to expand and refine Erica’s capabilities to provide clients further insights and guidance on optimizing cash flow, managing debt, monitoring transactions, capitalizing on savings opportunities and balancing competing priorities to reach critical financial goals.”

Categories: Conversational Intelligence, Intelligent Assistants, Articles

Beyond the Basics: How AI Is Transforming B2B Sales at TP

Beyond the Basics: How AI Is Transforming B2B Sales at TP  Five9 Launches Agentic CX: Toward AI Agents That Reason and Act

Five9 Launches Agentic CX: Toward AI Agents That Reason and Act  2025 Conversational AI Intelliview: Decision-Makers Guide to Self-Service & Enterprise Intelligent Assistants

2025 Conversational AI Intelliview: Decision-Makers Guide to Self-Service & Enterprise Intelligent Assistants  Talk to the Web: How NLWeb Opens Conversational Access to Site Content

Talk to the Web: How NLWeb Opens Conversational Access to Site Content