Enterprise Connect featured particularly noteworthy keynotes and panels as solution providers reflected on the impact of elements of AI on the Contact Center. Nobody emerged unscathed as a broad spectrum of companies tackle conflicting objectives of “openness”, differentiation and market segmentation.

Enterprise Connect featured particularly noteworthy keynotes and panels as solution providers reflected on the impact of elements of AI on the Contact Center. Nobody emerged unscathed as a broad spectrum of companies tackle conflicting objectives of “openness”, differentiation and market segmentation.

In past years, the solution was to punt, and default to brand-based messaging. “Unified Communications” (UC) provided broad cover. Under its umbrella, all a large infrastructure provider (then Cisco, Microsoft or Avaya) had to do was demonstrate how its branded approach could support both voice and data communications, collaboration, conferencing, messaging, video, productivity applications and contact centers.

That’s all changed now, as cloud-based platforms from Amazon, Twilio and Vonage join the fray and re-shape the very nature of product offerings and the criteria enterprise buyers apply when picking their vendors. Market leadership is now measured by the depth and breadth of services offered. Thankfully, the most relevant services fall into a mere three categories:

- CPaaS: “Communications Platform as a Service”, formerly referred to “UCaaS” or “Cloud-based UC”.

- CCaaS: “Contact Center as a Service”, which is the fastest growing sector of the contact center industry, but still represents approximately one-fifth of agent seats.

- Microservices Marketplace: referring to Web sites with links to multiple APIs that support a wide range of functions like CRM, productivity, but also elements of “artificial intelligence” and intelligent assistance such as transcription, translation, natural language processing, dialog management, and so on.

Last November (2018), when CPaaS pioneer Vonage acquired CCaaS stalwart NewVoiceMedia to complement its investments in Nexmo and TokBox (a library of microservices and specialist in streaming, respectively) we called it a defining moment for “the full solution stack for Conversational Commerce”.

New Stack, New Leaderboard

Vonage was not alone in offering the full Conversational Commerce stack. In the past two years, both Twilio and Amazon have bolstered their line-up. Twilio is the prototypic CPaaS provider and has added CCaaS under its Flex brand and already featured a voluminous amount of APIs and tools to support telephony, messaging and conversational intelligence. Amazon rounds out the roster of market leaders. AWS was already powering a number of CCaaS providers when it formally debuted Amazon Connect two years ago at Enterprise Connect.

The online retailer’s cloud-based subsidiary’s revenues have been growing at a torrid 47% in 2018 to approach $25 billion. Its marketplace includes APIs for microservices like Connect, which is a fully-programmable contact center but it has an impressive roster of related resources like Lex, which is the automated speech recognition and human-like text-to-speech platform that powers Alexa, among other things. At Enterprise Connect the company showcased how a business unit exec (as opposed to a developer) could spin up a chatbot in a matter of hours. AWS-resident APIs support transcription, translation and natural language understanding (Comprehend, which can “discover” the topics that are most often addressed in unstructured data).

Many of the APIs included in AWS are the functional equivalents of IBM Watson, available through the IBM Cloud as well as Microsoft Cognitive Services available in Azure. And, as we look across the spectrum of cloud-based “AI offerings for the Contact Center” we find Google falls solidly in this category as well. Unlike Amazon, Google has no intention to offer CCaaS. Instead, it has formed partnerships with about a dozen contact center partners, including Genesys, Cisco, Five9 and Mitel, in addition to the full-stack players Vonage and Twilio. It is an approach that has high-expectations for developers to custom build AI-infused contact centers capable of offering conversational user interfaces through chat, voice and messaging employing both live agents, chatbots and Intelligent Assistants.

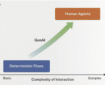

Segment According to Levels of Sophistication

The new stack leads to a lot of unanswered questions, primarily surrounding “Who owns the conversational contact center?” and “Are there enough developers to assemble solutions out of all the resources?” There is no single answer because the brands contemplating Intelligent Assistance and The New Stack are on their own journeys of discovery. The bulk of them are investigating how and where to get started and seeking a ‘proof of concept” to prime the pump for more bots. They want to take the low-code or no-code, packaged solution approach to launching a bot using a departmental level team for developers.

At the other end of the spectrum are experienced firms with deep chops in system design and process automation. They are well aware that intelligent assistance relies on dynamic data that is under the control of back office systems and processes. Whether launching a chatbot, voicebot or virtual agent, they know it will rely on context gained from real-time analytics of both structured data (CRM records, call detail reports, product catalogues) and unstructured data (chat transcripts, call recordings, product literature).

In between are veteran contact center managers, IVR administrators, “super agents” who are gaining experience with the new technologies, but still don’t know what they don’t know. These are the buying persona of today’s customer care and conversational marketing technologies. They are not as easy to categorize as it looks because the unspoken truth emanating from Enterprise Connect is that both sides (buyers and sellers) are filled with self-deceivers.

(picture credit: Google AI for Contact Centers)

Categories: Conversational Intelligence, Intelligent Assistants, Articles

2025 Conversational AI Intelliview: Decision-Makers Guide to Self-Service & Enterprise Intelligent Assistants

2025 Conversational AI Intelliview: Decision-Makers Guide to Self-Service & Enterprise Intelligent Assistants  Talk to the Web: How NLWeb Opens Conversational Access to Site Content

Talk to the Web: How NLWeb Opens Conversational Access to Site Content  Voice AI Agents Redefine CX: Trends, ROI, and Strategies for 2025

Voice AI Agents Redefine CX: Trends, ROI, and Strategies for 2025  Why Voice AI Is Foundational for Enterprise Innovation (Webinar)

Why Voice AI Is Foundational for Enterprise Innovation (Webinar)