Place Conference came to London last week in the shadows of the Tower of London — that famous, ancient English icon. Over the centuries the Tower has taken on a series of roles: a fortress, an armory, a palace, a zoo, and the list goes on. (Yes, a zoo). And today? A striking window into the past that educates and fascinates millions of people a year.

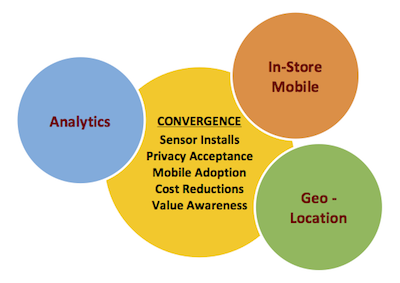

The Location Services industry, in its short history, has also undergone its own evolution. An evolution into what are now three overlapping segments: 1) Traffic Analytics 2) In-Store Mobile and 3) Outdoor Geolocation.

Prior to 2011, retailers used cameras and infrared devices for “location services” as a means to count the number of shoppers coming through the door. Vendors turned traffic data into business data; supporting retail executives who could make better decisions with that information. Most notable was the creation of Store Conversion reports and optimal Staff-to-Customer Ratios.

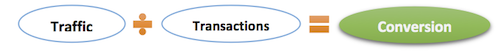

Store Conversion Equation: Determines the success of a store’s ability to convert shoppers into buyers.

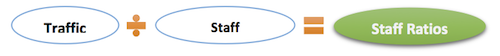

Staffing Equation: Optimal allocation of Staff-to-Customers as measured by revenue.

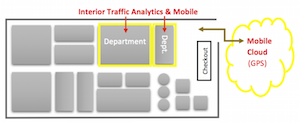

Once mobile phones enabled retailers to follow shopper paths, every radio on the phone became a sensor that took shoppers past the door and inside actual departments and even aisles. Cellular, GPS, Wi-Fi, Bluetooth, accelerometers and even the phone’s camera and microphone are used. Recent developments include beacons and LED lights that transmit location to the phone. All this in just three years.

The market is now teeming with indoor location analytics trials, a large number of small sales, and a small handful of large implementations. Let’s look at the disposition of each of these three segments:

1. Indoor Traffic Analytics is used in the same manner as traffic counting; generating data that retailers use to improve performance. The potential gains are exciting; multiple-percentage growth in revenue, profit, basket size, conversion and/or cost savings.  However the space is marked by slow adoption. It’s further hampered by privacy concerns and cost; multiplied by strained retailer technology budgets. But the ROI is significant and the number of trials and related retailer activity is nothing short of striking.

However the space is marked by slow adoption. It’s further hampered by privacy concerns and cost; multiplied by strained retailer technology budgets. But the ROI is significant and the number of trials and related retailer activity is nothing short of striking.

2. In-Store Mobile is the combination of store layout mapping and the ability for a store’s mobile app to deliver features that feed off the awareness of where the shopper is and where they were. This market was on a slow path due to a mismatch between perceived value and the high cost of infrastructure. It generally followed acquisition plans led by Traffic Analytics. But… it exploded in the past year with the advent of beacons; location transmitters boasting an insignificant cost to purchase and install. While utilization of store mobile apps is extremely low, the industry and market holds no shortage of mobile optimism and, more important, innovation.

3. Geolocation – Shopper behavior doesn’t start when they enter the retailers’ door. The ability to understand current and past, shopper GPS (outdoor) location can be combined with personalized and behavioral data to make contextual advertising and messaging extremely valuable. This industry garners huge attention from mobile advertisers, brands, ad networks, retailers and more. The geolocation industry has also exploded with investment and innovation while the challenge of downloads, open rates and app utilization are still and slowly being addressed.

– – – – – –

The three industries are growing and converging, and the intersection is driven by, well, three things:

1. Infrastructure. Retail indoor location infrastructure (installation of Wi-Fi, Bluetooth and other sensors) makes store traffic data available to outdoor (geo)location data held by ad networks, carriers, third party apps, etc. This “last mile” indoor traffic data is critical for geolocation players, while Analytics fans are rightfully eager for constant connection to the users outside the store and the holy grail of transaction Attribution. Retailers will finally be able to track shoppers as they traverse between online mobile, and then in the store.

2. Cost Reduction. This is a trick category as it includes not just a reduction in cost, but the extended appreciation of Location value. Market demand drives down hardware cost and into monthly SaaS budgets. Beacons also drive the cost down, and the proliferation of public Wi-Fi and LED fixtures reduces and distributes the expense. But Location systems can return investment without these factors when retailers gain confidence over analytics value and how to extract it. That will happen when early-adopters promote their success within the industry. The recent retailer investment in Omnichannel; looking at all lines of business as connected, is influential as well.

3. Consumer adoption. Every mobile consumer-engagement app requires an opt-in, and the majority of user experiences are through 3rd party and retail store-apps. In most cases the app must be actually open. Consumers still aren’t opening retailer apps while shopping, and the industry isn’t good, yet, at giving them a reason to do so. Look for growth of app open-rates as retailers give consumers reasons to do so.  “Resident apps” such as Facebook, Google and Apple’s operating systems will be disruptive factors, since they are always open, and eager to take their share of retail in-store value chain. And with app adoption comes consumer op-in – the best resolution to privacy concerns.

“Resident apps” such as Facebook, Google and Apple’s operating systems will be disruptive factors, since they are always open, and eager to take their share of retail in-store value chain. And with app adoption comes consumer op-in – the best resolution to privacy concerns.

This is all happening now.

In 2014 Apple announced built-in location fusion hardware and Google announced Project Tango to map interior spaces. In 2015, we’ll see the announcement of several chain-wide retail analytics installations to add to the partial-chain systems in-place. It will see retailers using mobile location apps to add to those that already are such as Walgreens, Toy ‘R Us and Macy’s.

We’re witnessing the Location evolution. With a cast of inspired participants. More than three, for sure.

Categories: Articles, Mobile + Location

Opus Research Welcomes Ian Jacobs as VP and Lead Analyst

Opus Research Welcomes Ian Jacobs as VP and Lead Analyst  United Airlines, TXU Energy, and Memorial Hermann Among Opus Research’s 2024 Conversational AI Award Winners

United Airlines, TXU Energy, and Memorial Hermann Among Opus Research’s 2024 Conversational AI Award Winners  Views from the NICE Analyst Summit: Introducing the Experience Continuum

Views from the NICE Analyst Summit: Introducing the Experience Continuum  Opus Research Announces 2023 Conversational AI Award Winners

Opus Research Announces 2023 Conversational AI Award Winners