A relatively paultry $475 million is the amount accepted by Nortel from Avaya as a “stalking horse” bid.

Articles

IBM Rushes In; Microsoft Exits SMB “UC Appliance” Market

IBM is amping up its efforts to provide a UC appliance to small businesses just as Microsoft has turned out the lights on its analogous product.

Rethinking Google Voice on Android and Blackberrys

The availability of Google Voice features on smartphones illustrates why number portability may not be as important as previously thought.

Nuance Nabs Jott; Targets Mobile Assistance, UC and CRM

The acquisition of Seattle-based Jott brings a few mature applications and a few hundred thousand registered users to Nuance’s suite of voice-enabled mobile services. Founded in 2006 as part of a small covey of firms specializing in mobile transcription, Jott… Read More ›

Major Update for Fonolo

Fonolo stepped up its efforts to swing the self-service pendulum closer to the customer with the release of a major update of its “Deep Dialing” platform.

Recession Spurs Innovation

We’ve been struck by some of the recent announcements surrounding activity in various “Labs” run by the luminaries of Search, Cloud Computing and IP-Telephony.

New Attention to Mobile Voice Control (Thanks Apple and Om!)

“How Speech Technologies Will Transform Mobile Use” is a topic that’s near and dear to my heart; but at this point I would frame the issue as “How Mobile Use Will Transform Speech Technologies.”

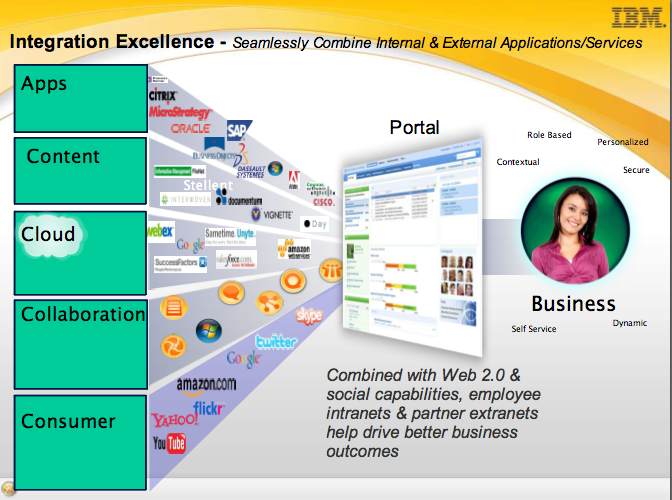

IBM Touts Its Portal and Mashups

IBM is engaged in marketing, packaging and general boosterism to accelerate deployments of highly dynamic, personalized and (in many cases) mobile portals.

IfByPhone Promotes Call Distributor

cloud-telephony pioneer IfByPhone has formally launched a slew of self-service and routing services under the name “Call Distributor.

Speakers at Cisco Live Stress Smartphone-based Collaboration

Without using the specific term “Fixed Mobile Convergence”, executives from Cisco used the Cisco Live (formerly “Networkers!”) conference to describe a pivotal role for smartphones.