Vonage’s transformation from a residential VoIP (“voice over IP”) provider to a Communications Platform as a Service (CPaaS) is the Good News story of 2021. It certainly caught the attention of Stockholm-based Ericsson, a global provider of communications infrastructure and services, whose own legacy dates back to 1876. In a deal that is expected to close in 2022, Ericsson plans to buy Vonage’s stock for $21 per share, or approximately $6.2 billion. It expects immediate benefits as the addition of Vonage’s APIs, video capabilities, customer base and R&D investments enhances the value of its core wireless infrastructure business.

Vonage’s transformation from a residential VoIP (“voice over IP”) provider to a Communications Platform as a Service (CPaaS) is the Good News story of 2021. It certainly caught the attention of Stockholm-based Ericsson, a global provider of communications infrastructure and services, whose own legacy dates back to 1876. In a deal that is expected to close in 2022, Ericsson plans to buy Vonage’s stock for $21 per share, or approximately $6.2 billion. It expects immediate benefits as the addition of Vonage’s APIs, video capabilities, customer base and R&D investments enhances the value of its core wireless infrastructure business.

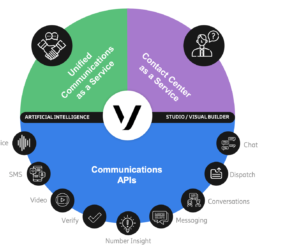

The Vonage Communications Platform (VCP) is the foundational element to the acquisition. It is a technology stack designed to simplify efforts to infuse communications services with Conversational AI. In a conference call with analysts, Ericsson’s president and CEO, Börje Ekholm,President, shared his vision of Ericsson’s future growth predicated on the expansion of 5G based services and the proliferation of the intelligent endpoints that comprise the Internet of Things (IoT). As a stand-alone business, Vonage provides services to roughly 120,000 business customers. It also supports a network of 1.1 million developers and has over 780 engineers supporting its API platform.

If the transaction is approved by its shareholders, Ericsson expects its core infrastructure to work to ensure the levels of speed, Quality of Service (QoS) and lack of latency required to provide useful services “whether it’s just calling a taxi or opening a bank account.” In its announcement to the public, Ericsson positions the combined resources as a “global network and communications platform for open innovation” with an emphasis on the tools and APIs it providers to developers and business customers. Given the investments and acquisitions that Vonage has made in recent years, Opus Research also sees the VCP as the conduit for introducing Conversational AI to a broad spectrum of communications services.

Success Depends on Execution

Vonage’s recent history of acquisitions might serve as a blueprint for Ericsson as it executes on its vision and efforts at transformation from a pure communications infrastructure provider to the operator of an open platform for innovation. The pieces are all there; starting with Contact Center as a Service (CCaaS), where Vonage’s successful assimilation of NewVoiceMedia brought a strong link with Salesforce and the community of of customers and developers availing themselves of Service Cloud. Likewise, Nexmo, which was purchased in 2016 has led to rapid growth in the customer base and usage of a library of APIs.

Ericsson deserves a lot of credit for seeing the great strides Vonage has made in carving out market share in these business communications communications domains. It sees growth rates in enterprise spending int he 30% per annum range and an expansion of its Total Available Market (TAM) that could reach $60 billion in less than five years. But the competition will be formidable. In CCaaS alone, it will find the likes of NICE CXOne (formerly InContact), Genesys, Five9 and others. Nexmo’s assent in the Communications Platform as a Service market has found steady competition from Twilio and the threat of commoditization from cloud-based offers from Amazon Web Services and Google.

Ericsson made it clear that it is taking a long-view on the acquisition. In the near term it will invest in strengthening Vonage as a stand-alone business by investing in the high-growth, VCP-enabled segments. In the longer run, it sees potential to strengthen its own investment in packaged wireless services for enterprise customers. The expertise in wireless (both 4G and 5G-based) and high expectations with IoT (which will benefit greatly from Vonage’s investment in Conversational AI) are the real differentiators.

Categories: Intelligent Assistants

2025 Conversational AI Intelliview: Decision-Makers Guide to Self-Service & Enterprise Intelligent Assistants

2025 Conversational AI Intelliview: Decision-Makers Guide to Self-Service & Enterprise Intelligent Assistants  Talk to the Web: How NLWeb Opens Conversational Access to Site Content

Talk to the Web: How NLWeb Opens Conversational Access to Site Content  Battling ‘Botenfreude’: The Power of People and Policy

Battling ‘Botenfreude’: The Power of People and Policy  Voice AI Agents Redefine CX: Trends, ROI, and Strategies for 2025

Voice AI Agents Redefine CX: Trends, ROI, and Strategies for 2025