The formal, public launch of WhatsApp’s Chat Ads and Business API, on August 1, marks progress in the evolution of Conversational Commerce’s service delivery infrastructure. In the eight months since parent company Facebook made single-button access to “business chat” using WhatsApp (rather than Facebook Messenger) a thing, a reported 300 million of WhatsApp’s 1+ billion “active” users are actively engaged in chats with 90 select brands.

The formal, public launch of WhatsApp’s Chat Ads and Business API, on August 1, marks progress in the evolution of Conversational Commerce’s service delivery infrastructure. In the eight months since parent company Facebook made single-button access to “business chat” using WhatsApp (rather than Facebook Messenger) a thing, a reported 300 million of WhatsApp’s 1+ billion “active” users are actively engaged in chats with 90 select brands.

They are “select” brands because the community has been carefully cultivated and curated by WhatsApp and its parent company. Recall that Facebook and a group of partners launched a service to link Messenger to the e-commerce and customer interaction infrastructure of leading brands back in October 2015. In this post, I made reference to a demo executed in conjunction with [24]7.ai. In the years that followed, the claims on the Facebook Messenger for Business landing page speak volumes; i.e. a volume of 2 billion messages between individuals and brands each month.

This provides empirical evidence that (a) there is demand for messaging services between brands and their customers and (b) Facebook and partners have solved some of the issues associated with handling high-volumes of text-based interactions through both live agents and bots.

Success Breeds Competition, From Within

Yet it is the very success of Facebook Messenger for Business that exposed the need for new features, functions and, frankly, constraints. That’s where WhatsApp comes in. With end-to-end encryption and strict attention paid to protecting its subscriber’s privacy the appeal to end-users was obvious. As political and economic realities took over, positioning WhatsApp as a service for businesses became a highly logical outcome and necessity.

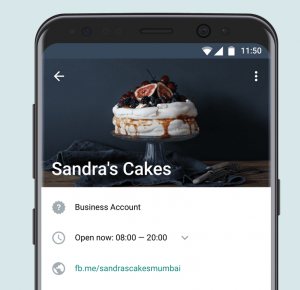

By September 2017 WhatsApp began to work with businesses large and small to craft its offering. It started with an Android App that gave businesses detailed profile (including email, listing and Website), statistical tools to monitor the delivery and performance of messages, and automated messaging tools to help them respond quickly to customer messages or queries. The offer was one of the first efforts for Facebook to “monetize” its acquisition. But it also exposed the tremendous appeal of WhatsApp as a trusted platform by the billion or so people who used it regularly.

Such a “YAWN”

WhatsApp’s announcement comes hot on the heels of Apple publicizing the growth of its Business Chat. In my coverage of Apple Business Chat, which is still in beta, I called it a YAWG, for “Yet Another Walled Garden”. In retrospect, that was a missed opportunity. I should have characterized it as a YAWN, for “Yet Another Walled Network”. I thought about it, but didn’t pull the verbal trigger. Now I wish I had, because, as a subsidiary of the primordial Social Network, WhatsApp makes it blatantly clear that its value is the product of the network effect. The network of one billion users is of tremendous value to the yet-to-be-defined network of businesses who are registering to put the platform to use.

A true platform creates its own ecosystem by fostering business opportunities for a network of partners in ancillary and adjacent businesses. This is definitely the case for WhatsApp Business API. The buzz around the API’s launch was amplified by announcements from the following enhanced messaging platforms like GupShup (who claims to enable Citibank, DishTV, Kotak Mahindra Bank, IndusInd Bank, and ICICI Bank to gain early access to WhatsApp Business API), Smooch.io (Four Seasons Hotels) and Twilio (which has established a “sandbox” for its clients to begin to test the features and functions that integrate WhatsApp Business API to contact center, messaging and ecommerce infrastructures).

The Special Case of Spark Central

Expect the ecosystem to be rounded out by an emerging category of firms that are redefining conversational engagement. Sparkcentral, which grew out of the early days of social networking is a case in point. Positioned in front of Smooch and Twilio, Sparkcentral has already become brought access to the WhatsAPP Business API to KBC Bank & Insurance, citizenM, ENGIE Electrabel and Elsevier.

This is a unifying effort because Sparkcentral’s core offering is a centralized agent dashboard and reporting tools that combine both social media and messaging. The large businesses that WhatsApp Business API is designed to appeal to will be appreciative of this approach as they sort out their strategy for supporting marketing, sales and support through traditional voice agents and live chat agents while the world is migrating to messaging platforms and self-service options.

And WhatsApp Claims its Own

Let’s not forget that the announcement of WhatsApp Business API cited several existing clients, presumably with direct access to the API. They include: Booking.com, MakemyTrip, Uber, Wish, B2W, iFood, Singapore Airlines, Melia Hotels, KLM, Bank BRI, Absa, Coppel and Sale Stock. Many vendors on the Conversational Commerce landscape lay claim to a few of the firms on this list. It goes to show how fluid the ecosystem is these days as new entrants and approaches muddy the boundaries between and among platforms.

It’s WhatsApps’ ecosystem to manage as it sees fit. With the August announcement, we expect to see the use of messaging platforms for conversational commerce to accelerate.

Categories: Intelligent Assistants, Articles

2025 Conversational AI Intelliview: Decision-Makers Guide to Self-Service & Enterprise Intelligent Assistants

2025 Conversational AI Intelliview: Decision-Makers Guide to Self-Service & Enterprise Intelligent Assistants  Talk to the Web: How NLWeb Opens Conversational Access to Site Content

Talk to the Web: How NLWeb Opens Conversational Access to Site Content  Battling ‘Botenfreude’: The Power of People and Policy

Battling ‘Botenfreude’: The Power of People and Policy  Voice AI Agents Redefine CX: Trends, ROI, and Strategies for 2025

Voice AI Agents Redefine CX: Trends, ROI, and Strategies for 2025